Payroll Tax Talbes

TAX TABLES

PURPOSE:

This menu option stores the tax tables necessary for proper calculation of Income Tax. KLM Software provides a current set of tax tables. These Tables must be updated, each time Revenue Canada updates the Income Tax calculations. (1 January and 1 June currently)

As these files have a direct effect upon the calculation of Income Tax, it is a display only option. The tax tables are display only.

REQUIREMENTS:

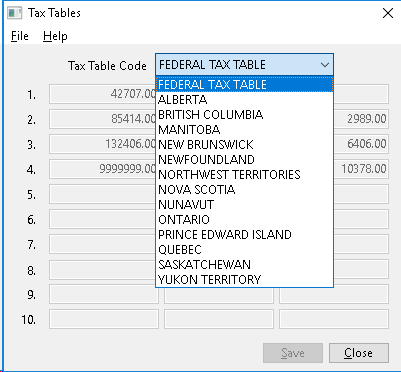

For multiple company users; if some companies are set up for other provinces, a Tax Table WILL exist for each Province.

The following Tax Table CODES have been reserved for existing tax tables:

- {A} Alberta (V1-T3)

- {B} Federal TAX

- {C} Saskatchewan (Y)

- {D} British Columbia (V1 Calc.)

- {F} Quebec 2 (Surtax)

- {M} Manitoba (TH & Y)

- {N} New Brunswick (V1 Calc.)

- {O} Ontario (T3)

- {P} Prince Edward Island (V1 Calc.)

- {Q} Quebec Provincial Tax

- {R} Yukon Territories (V1 Calc.)

- {V} Nova Scotia (V1 Calc.)

VIEWING EXISTING TABLES

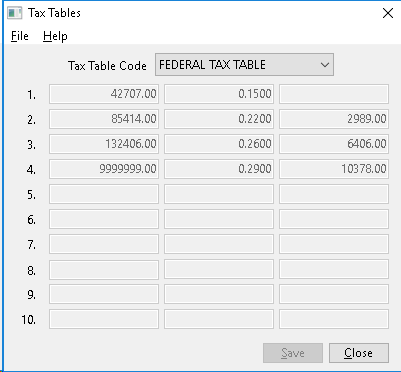

When you enter this option, the program will display the TAX Table for the FEDERAL Tax calculation. This is a display only screen.

To view the various PROVINCIAL Tax Tables, CLICK on the down arrow (to access the Pull Down Menu), to show the list of available tax tables for viewing. Move your cursor to the table you wish to see, than CLICK once. The new table will appear.

The table will display as 3 columns across and 10 lines down. The columns do not have headings but represent the following:

COLUMN |

DEFINITION |

1 is Up To $ Amount |

This is the Look-Up Amt (in dollars), that the program will use to decide which income range (of the tax table) an employee will fall under (for tax percentage). The dollar amounts represent the annual income amounts. For last entry of any table, the value will be 999999 which tells the program that this is the end of the file. |

2 is Rate-(R) |

This is the rate for the value of R (in the tax table). The value is always a 4 digit percentage. |

3 is Rate-(K) |

Optional. A second value may be placed here depending upon tax table look up value of K (for Constant) from the appropriate tax table will be placed here. |