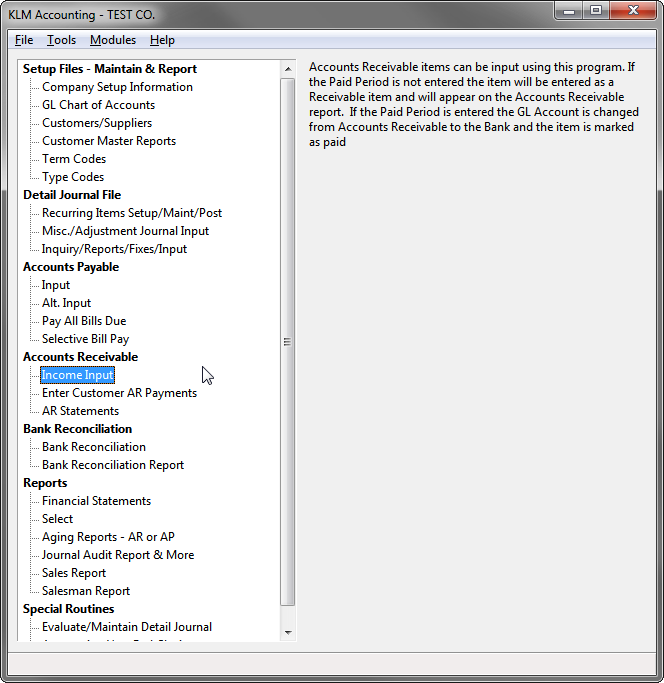

ARInput

AR (Order / Entry) INPUT

PURPOSE:

All valid company revenue must be entered into the journal, and this option was designed to allow a simple method of doing so, as well as perform the following helpful tasks;

- Payments (monies received): Indicate a transfer of money into any bank Account or petty cash as well as an applicable revenue account and any GST, PST or HST collected from that revenue.

- Unpaid Invoices (AR): Place an Invoice into Accounts Receivable to keep track of money owed to your company by your customers. These items can be paid through AR Payments.

EFFECT:

Journal entries created from this option are used in the following Accounting functions;

- Financial Statements; especially the Income Statement, which shows the net profit or loss for your Company, based on a comparison of expenses and revenue (see Financial Statements).

- The revenue acct. assigned during input will control where on the income statement each revenue shows up. This is important for keeping a handle on where your money is being made and what percentage of revenue is being taken in by that type of revenue.

- For sales that have been entered as paid, the payment will effect your current bank balance. These journal records are needed for doing bank reconciliations (see Bank Reconciliation).

KEEP IN MIND:

POSTING

Once saved, input is posted directly to the journal and can not be altered directly from this program. You may put "-" amounts to reverse a prior input entry, but it is a good idea to get in the habit of pausing before you post an entry, to check your input one last time.

AUTOMATIC FIELD SETTINGS

Special COA Master Record access, due date, payment discounts, GST/HST & PST values are set only when the Invoice Total Amount is entered. If you cursor up after this point and change the COA number or Invoice date you may wish to re-type the Bill Total to pickup any variations caused by these two fields.

OTHER

The sales posted are displayed on the bottom of the screen for your information, in case you are distracted.

MASTER FILE CONNECTIONS:

Company Master record

Used to define the default GL Accounts for payment discounts, GST, PST, Bank and AR, also the default Days to age and period ending dates.

GL Chart Of Accounts

All GL Accounts must be setup in this master file before you use them.

Customer/Supplier (COA) file

You must enter a valid COA# when entering unpaid sales, so the system can help you keep track of who owes you money.

In In addition, the COA Master Record can help speed up input by accessing optional fields that effect the following;

- The AR Terms field against the COA master record can tie into the Terms Master File to customize the following input fields for each customer.

- Due Date is based on Invoice Date + Days to age. You can vary the{days to age}through the optional field in the Terms master record.

- Payment Discount can automatically be calculated based on the optional discount percentage field against the applicable Terms record.

- TERMS FILE is only accessed if you have either the full Accounting, Inventory or Job Costing System.

- The GL Account defined in the COA Record will be assigned as a default to the Revenue a) GL Account field. Use this fact to speed up input.

- GST and PST calculations are based on the Invoice Total and GST/PST information supplied by the COA master. For example, if a customer is PST exempt then no PST will be assigned nor will it assume the total includes any PST.

INPUT FUNCTIONS

- Enter into appropriate fields (see field explanations)

- When ready to save the entries to the Detail Journal, click on POST CURRENT INPUT.

- Your entry (both sides) will appear at the bottom of the current screen.

- IF you make a mistake but have not posted yet. Move to the appropriate field and change it.

- IF you make a mistake and have already posted. Post another sale to reverse the mistake then post the correct sale. Reverse means same amounts but opposite sign +/-.

AUDIT REPORTS

- The program automatically produces an audit report, that can be accessed at a later time.

- To access the AUDIT report for this (or any option), go to TOOLS Menu (from the main Accounting Screen) and select AUDIT VIEWER.

SAMPLE TYPES of INPUT Records

The following are some examples of entries that can be made using this option and the results said entries will produce.

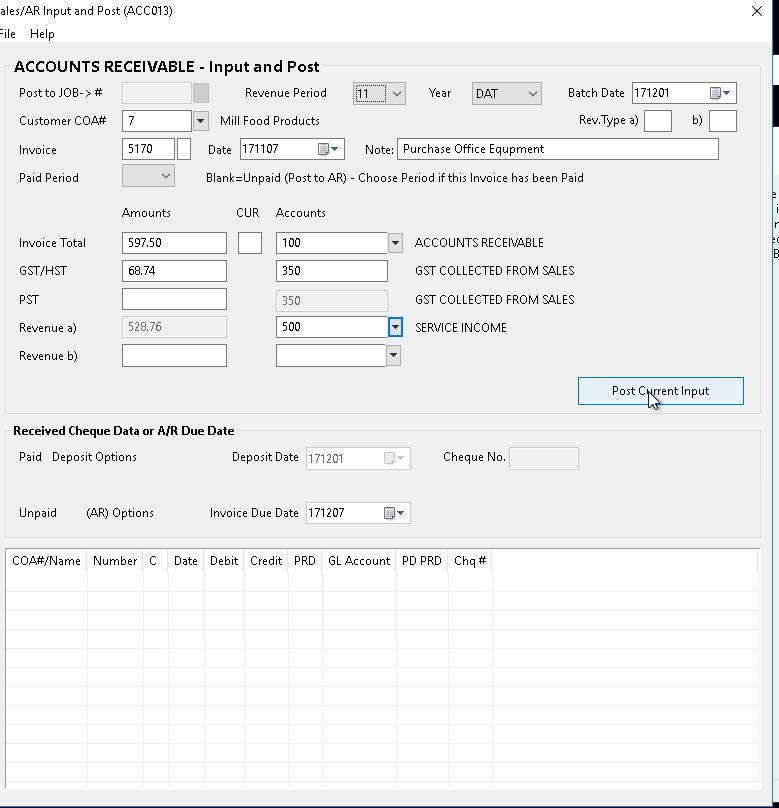

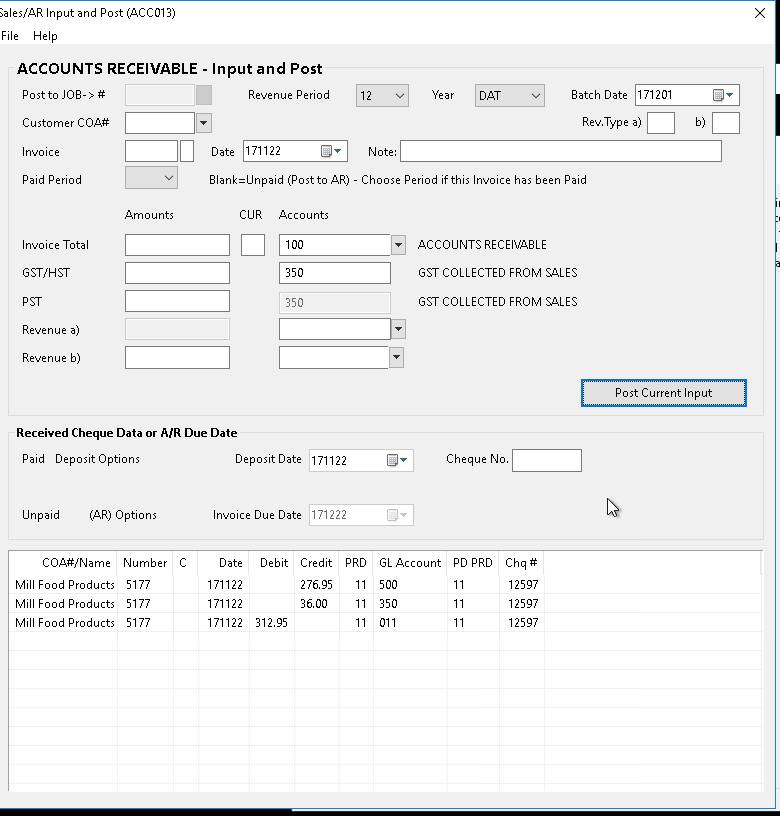

1) Below is a simple revenue (sale) that is still outstanding (has yet to be paid).

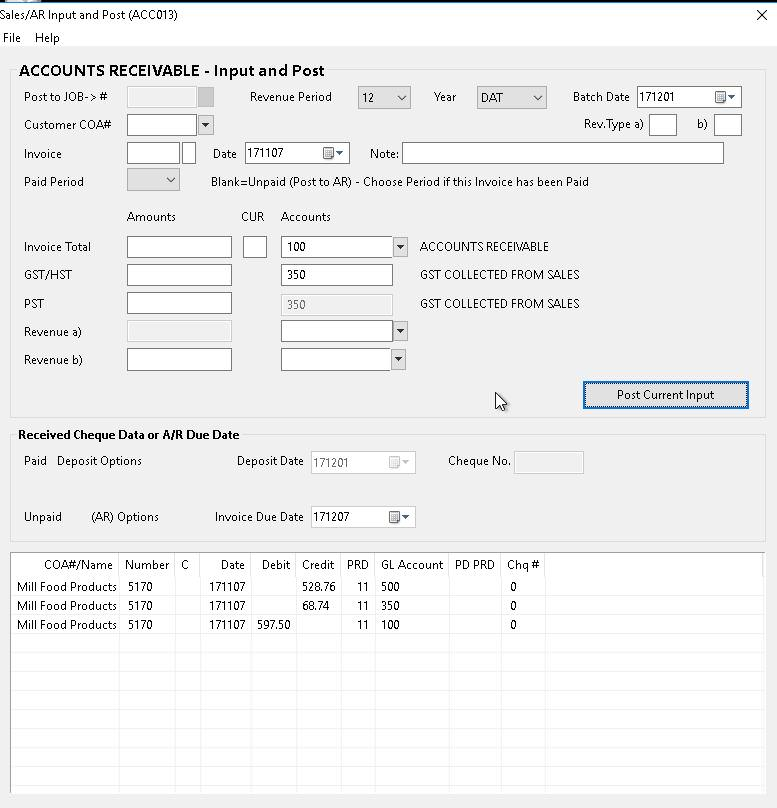

The above entry will produce 3 journal records; for revenue, GST/HST and outstanding Accounts Receivable. This is the result that will appear below, once this entry has been POSTED.

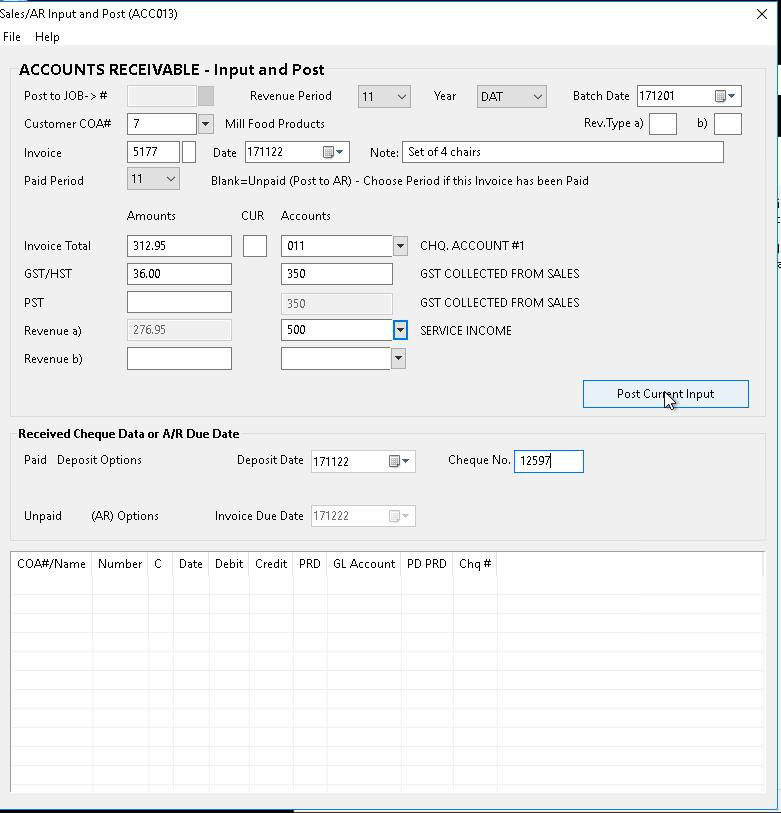

2) Below is an revenue (sale) that has been paid, for which a cheque was received.

The above entry will produce 3 journal records; for revenue, GST/HST and GL Bank Account. This is the result that will appear below, once this entry has been POSTED.

INPUT FIELD EXPLANATIONS

Each of the following input fields effect how and where the new journal records will be posted, as well as become part of the records created.

FIELD |

DEFINITION |

Post To JOB # |

This field will remain shaded, unless you have the Job Costing program activated. Enter a valid Job # if applicable. These numbers are setup in the Job Costing System.. If a Job# is entered the invoice total will be applied to the Job Costing to keep track of total billed against a Job. |

Revenue PERIOD |

This period is set for you, based an{Invoice Date} look-up in the period ending dates against the selected Company. The revenue period and/or year can be changed if needed. |

YEAR |

The program will default to (DAT) for the current data year. If unpaid sales, are posted to a Year other than DAT (currant year), than an outstanding AR entry for period zero is posted to the current year and the entries are posted to the prior year. |

Batch DATE |

Represents the month and day from the current system date. It will be assigned to the transaction date field in the journal records created. This can be a useful tool for doing journal inquires of all entries produced in the same day or range of days. |

CUSTOMER COA # |

If the sale is to be left Unpaid you must enter the appropriate customer, to keep track of who owes you money. For paid sales this field is optional. Days to age, PST, GST, payment discount, and GL Revenue account may be effected by information against the Customer's COA record. |

REV. TYPE a) b) |

OPTIONAL. These fields are used in Job costing reports to group like revenues together. It also can be used to indicated different markup rates for each grouping. |

INVOICE # |

You should assign a reference number to all new sales. This will help tie together, the two or more journal records created from posting a sales. |

Invoice DATE |

Changes to this field will effect the Revenue Period and the Due Date. Use the “Select Date” (down arrow) to pick the Invoice Date. |

NOTE |

This field is optional, and will be applied to all journal records posted for this sale. This note will show on AR statements. |

PAID PERIOD |

Leave this field blank if the sale is not paid. Otherwise use this field to indicate in which period the bank or petty cash account was effected. This can be the same as the revenue period, but in most cases the payment is made in a different month than the revenue was generated. Assign carefully, many functions are tied to this field. For your information; if the paid period is filled in and it is different than the revenue period, a reconciled AR, into the revenue period and out in the paid period is created for balancing each period's transactions. |

INVOICE TOTAL |

Should include PST and GST. Do not include any payment discount if you intend to use that field. Once entered the program will trigger a series of functions that will set the following fields; PST, GST, Due Date, Amount for Revenue a), and any payment discount based on AR Terms. |

CUR (Currency Type) |

OPTIONAL: Is used to convert bill revenue dollars that may be in another currency to your companies main currency. The sales values will be stored in the Job Costing System at the converted value based on the conversion rate against this type (MENU #4-Class "C") at the time of posting. |

GL ACCOUNT |

To post Invoice Total is based on the Paid Period and the Company defaults for the Bank Account and AR Account. If the sale is paid, (Paid Period filled in) the default Bank Account is assigned and you may vary this account to other bank accounts or petty cash if appropriate. If the sale is unpaid}(Paid Period left blank) the default AR Account is assigned and you may vary this to another AR Account if appropriate. |

GST/HST |

The GST/HST is calculated for you, but you must verify and correct it, if necessary. This value is used to set the true revenue amount and is used during GST/HST remittances. The GST/HST is posted to the forced GST/HST GL Account displayed; it is pulled from the Company GL defaults in the Company Setup Information File. |

PST |

The PST is calculated for you, but you must verify and correct it, if necessary. This value is used to set the true revenue amount and is used during PST remittances. The PST is posted to the forced PST GL Account displayed; it is pulled from the Company GL defaults in the Company Setup Information File.. |

REVENUE A) |

Enter an appropriate main GL Revenue Account for the sale. |

REVENUE B) |

The amount is set for you and will be adjusted accordingly if a secondary Revenue $ and GL Account is entered. Revenue a)is mandatory (except with opening AR balances) but Revenue b)is optional, and used only if needed. |

DEPOSIT DATE |

Applicable only if Paid Period is not blank. When the sale was paid. Will be assigned to the journal due date. |

CHEQUE # |

Applicable only if Paid Period is not blank. Leave blank for cash payments. Use the customer’s cheque number from the payment cheque. |

DUE DATE |

Options Applicable only if Paid Period is blank. The Due Date is automatically assigned based on the Invoice Date + days to age (varied using COA AR Terms). This field will effect your AR Aging Report. |