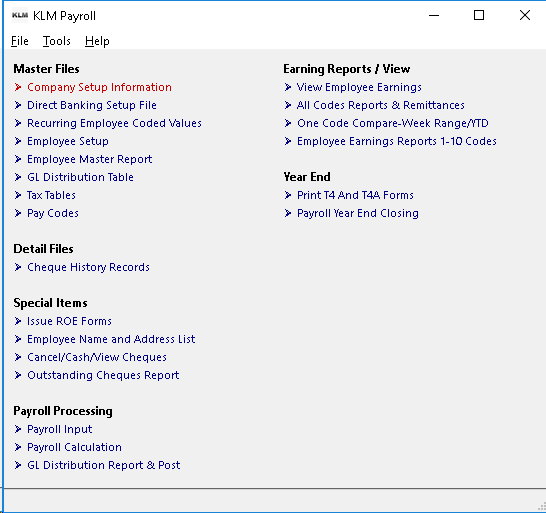

Company Setup

Company Setup Information

Purpose

Required SETUP information necessary for the proper operation of all KLM programs. Setup a Company for every EMPLOYER remittance number you will be remitting for.

Required Setup

- Company Master Record - Name, Address ...

- Pay type (i.e. weekly), rates for UIC, EHT .....

- Defaults for TD1s, Vacation Pay %, salaried hours ...

- If you have other KLM Systems active, also do the required setup in this shared file for those systems.

The first Company (01) added should be your main company, as it will be the default for all screens in this package.

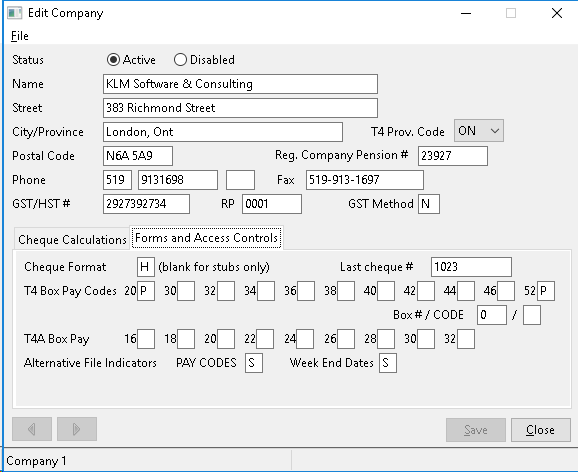

Adding a Company Record

1) Click on the FILE option, then click on NEW.

2) You will then be provided with the next available Company number and the EDIT screen for this company (on the right side of screen) will become active.

3) Fill in the appropriate fields (see field definitions if unsure of field contents), then SAVE the newly created record.

Note: You can add up to 99 companies.

Update an Existing Company Record

1) Select the appropriate Company Record from the list provided. The Company record EDIT screen will then appear to the right. Make any changes then click on the SAVE button.

2) Company records can not be DELETED but you can mark a company as Inactive. A Company number can be reassigned to a new company,(only if no Payroll records have ever been generated)for that company.

Printing a List of Companies

1) From the main screen for this option, click on FILE, then select PRINT. Follow the prompts to print a list of active companies.

Field Explanations

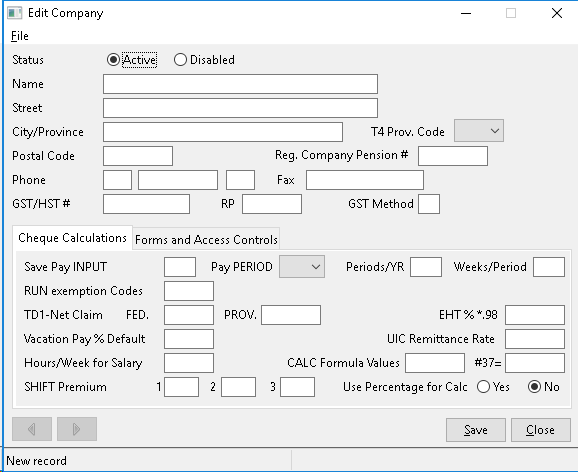

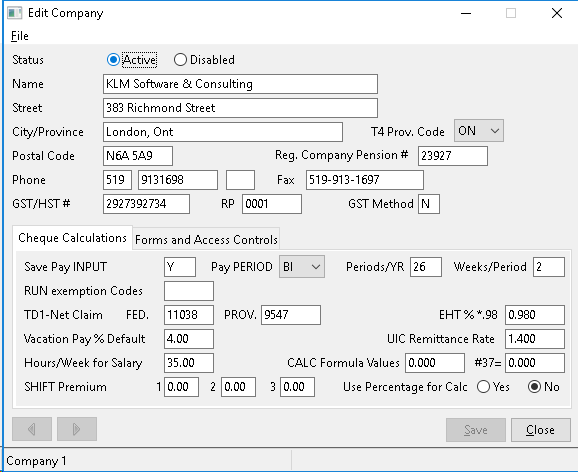

Each record is divided into 3 sections, as follows:

COMPANY DETAILS: Top Half of 1st screen.

Field |

Definition |

COMPANY NO |

Is a display only field. The Company Number is assigned by the program when the company is created and cannot be changed. |

STATUS |

Will be either ACTIVE or DISABLED to indicate company is not being used any more. |

NAME |

Enter the company name that you want to appear on report headings. |

STREET |

Enter the mailing address of the company. This information will appear on T4 and ROE forms. |

CITY, PROVINCE |

Enter the City followed by the Province of this company. This information will appear on both T4 and ROE forms. |

T4 PROV. CODE |

Enter a corresponding code for the province your payroll is for.The T4 PROV CODE determines the provincial Tax Rate and pay code calculations that are used. Use the pull down menu to select a valid entry |

POSTAL CODE |

Enter a valid Postal Code. Do not include the space. This information will appear on T4 and ROE forms. |

PHONE |

Area Code/Phone Number/Optional Office Extension |

FAX |

Phone number for fax machine (the area code is assumed to be the same). |

GSHT/HST No |

Enter your BUSINESS NUMBER for Payroll (EIC/CPP/TAX) remittances. |

RP |

Enter RP extension number to the Business Number for use on T4's and record of Employments. |

GST Method |

For most provinces, GSTis calculated on the sub-total of an invoice the same as PST. For QUEBEC this field must contain a Y }to indicate the different method of calculating GST ==> GST=(Sub- Total + PST) x %. |

REG COMPANY PENSION NO. |

Optinal number to be printed on T4 forms. |

CHEQUE CALCULATIONS TAB .

The information in these fields is used in calculation of employee pay cheques.

Field |

Definition |

SAVE PAY INPUT |

Enter Y only if you wish to re-use your cheque input file (#19) for each pay run. Entering N (for no) tells the system that you want the input "deleted" after each payroll run is processed. |

PAY PERIOD |

Select one of the following payroll frequency types; WE for Weekly BI for Bi-Weekly SE, for Semi-monthly, MO for Monthly or YE for Yearly |

PERIDO / YR |

Enter the number of pay periods per year. Valid entries are: 52 for Weekly, 26 for Bi-Weekly, 24 for Semi-monthly or 12 for Monthly. |

WEEKS /PERIOD |

Enter the number of** weeks per pay**. The #OF weeks will appear in the cheque input records. Valid entries are: 1 for Weekly, 2 for Bi-Weekly & Semi-Monthly, 4 for Monthly |

RUN EXEMPTION CODES |

Optional: You can select up to 6 valid PAY CODES that are automatically calculated on pay cheques in Menu #20 if you DO NOT wish the values to be calculated. |

TD1-NET CLAIM - FED |

Set to the Federal TD1 single exemption amount for the current year, used as default for all employees with no TD1 value in the employee master record. TD1 amounts are used in the income tax calculation. |

TD1-NET CLAIM - PROV |

Set to the Provincial TD1 single exemption amount for the current year, used as default for all employees with no TD1 value in the employee master record. TD1 amounts are used in the income tax calculation. |

EHT % |

Employee Health Tax percentage used to calculate EHT remittance. This value must be evaluated each remittance period and is based on the gross payroll for the period. Only the province of Ontario uses the EHT rate. |

VACATION PAY % Default |

This value is used for a default for all employees with no VAC% override in their employee master record. The VAC% is used to calculate Vacation pay. |

UIC REMITTANCE RATE |

This field is set to the default UIC employer remittance rate. Only with written government permission for a reduced rate can you change this value. If you are using a rate other than the standard one, you must maintain this value, as KLM is not notified to changes affecting individual companies. |

HOURS/WEEK - SALARY |

Record the number of hours in a standard work week (i.e.40 hrs.). This information is used to determine a hourly wage for any salaried employee. |

CALC FORMULA VALUES - 24 / 37 |

24 Flat tax rate is to be used in calculating tax for the following earnings; D=Commission, B=Bonus, and S=Severance. 37-Flat rate to be used in calculating the remittance amount for the Workmen's Compensation Board (pay code w). |

SHIFT PREMIUM |

The Shift premium option allows you to apply an extra dollar amount to an employee's hourly wage. The figures entered here can be applied as straight dollar amounts or as a percentage (i.e. .25 would increase the employee's wage by 25%). |

METHOD |

Uses with the Shift Premium fields MUST contain a Y if percentages are required. |

FORMS AND ACCESS CONTROLS TAB

The information in these fields is used in by a varity of programs including printing of T4s and processing of payroll cheques. .

Field |

Definition |

CHEQUE FORMAT |

The letter placed here, represents one of the cheque styles offered by KLM. The main ones are: I for Cheque / short stub, Y for cheque / long stub or BLANK to print stubs only. Custom cheque layouts are available. Contact KLM for further information. |

LAST CHEQUE No |

Program updates this field automatically but you can enter a starting CHEQUE number the first time you create a new company record. You may also update this field, should the number become incorrect. |

T4 BOX PAY CODE |

Using a T4 form as a reference, to select PAY CODES corresponding with the box number on the T4 Form. |

T4 BOX NO /CODE |

Enter a T4 box number and PAY CODE to apply an additional value to a box number. |

T4A BOX PAY CODES |

At present, this package does NOT print T4A forms. Leave these fields blank. |

PAY CODES |

This field is set automatically by T4 PROV. Code. Leave this field as is unless instructed otherwise. The letter/number effects the entire pay calculation in MENU #20 and all Pay Code program references. |

WEEK END DATES |

Refers to the WEEK Ending DATES File accessed from from the Payroll MAIN Menu (a default file is assigned to you represented by the letter S). This indicator will allow you to have multiple Week Ending DATE files based on the Company being paid. (see Week Ending Dates file information for details). |

NOTE: PAY CODES Refers to the PAY Calculation CODES file in Payroll Menu #8 (which is given to you as part of the data setup files). Valid codes are:

A = Alberta B = British Columbia C = Saskatchewan M = Manitoba S = Ontario P = Prince Edward Island V = Nova Scotia N = New Brunswick Q = Quebec R = Yukon, Newfoundland/Labrador/Northwest Territories