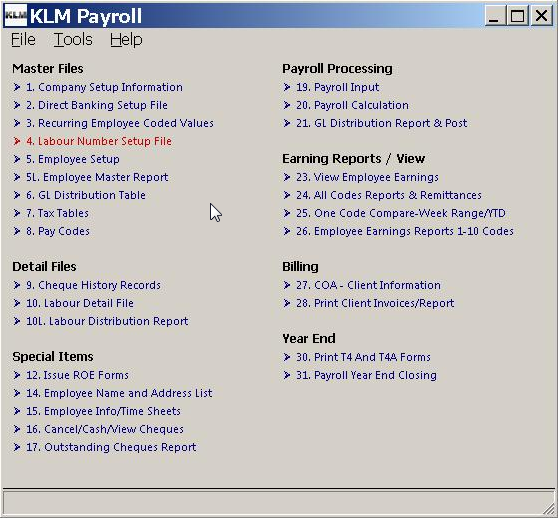

Labour-Number-Setup-File

LABOUR NUMBER SETUP FILE

PURPOSE:

This option is only available with the Labour Distribution Feature. Setup of this file is optional.

The Labour records set up in this file, can be used to alter the pay and/or bill rates of labour records entered into Pay Input or Manual entry of Labour Records (Labour Detail File). Labour numbers can be used to identify different kinds of earnings, such as piece work or mileage (payment per run or job).

REQUIREMENTS:

The following files have to be setup before records can be entered:

- A Valid COMPANY Master (Menu #1)

- Valid EMPLOYEE Master File (Menu #5)

- Valid PAY CODES File (Menu #8)

GENERAL:

The settings in this file that will override the contents of related fields in Pay Input or Manual entry of Labour Records whenever a Labour Number is entered are:

- S (Status) of labour detail line

- D (Department Number)

- Employee Pay rate

- Customer Bill Rate

- Time# (last field in labour detail lines)

Details from this file, such as description, will print on cheque stubs, reports requested in the Labour Distribution Report and customer invoices (Print Client Invoices)

There is no limit on the number of records that can be created. This file is not deleted or renamed (at year end).

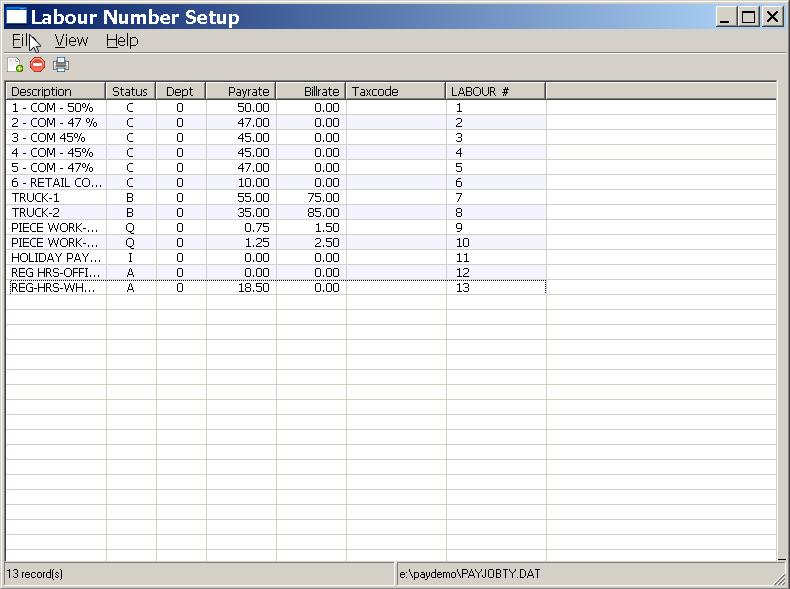

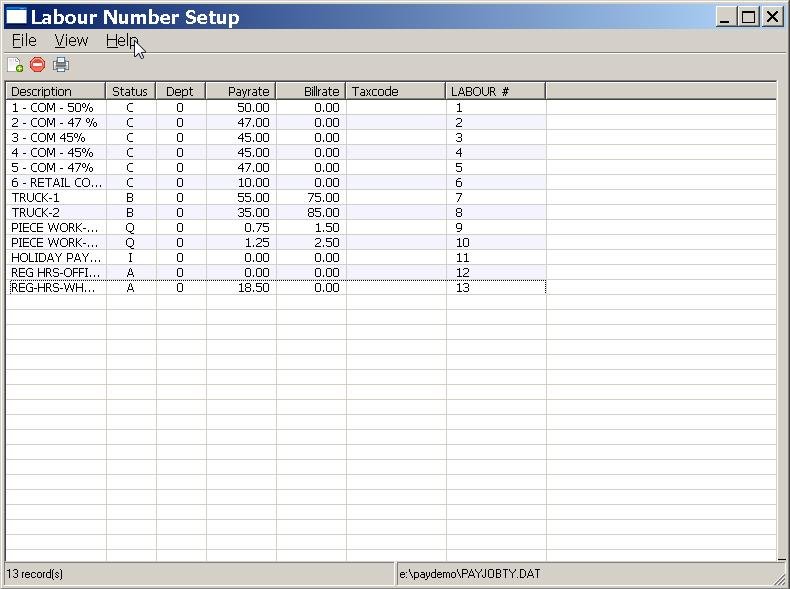

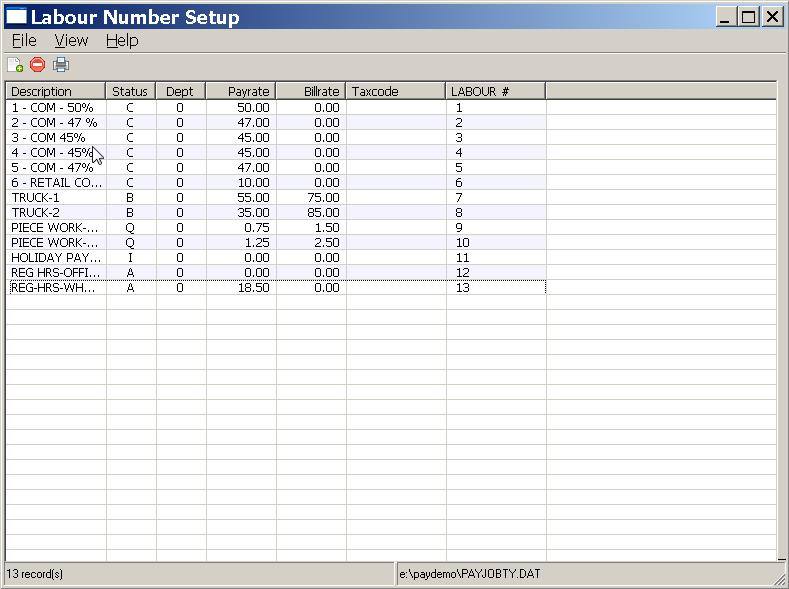

When started the program displays a list of ALL labour records (LABOUR NUMBERS) in this file. The List is in LABOUR # order, when by default but can be sorted by any column by CLICKING once on the column heading, such as STATUS.

Keep In Mind:

- Labour numbers can be setup to calculate items such as mileage, commission percentages, statutory holidays etc.

- Lay out exact calculations on paper before attempting to manipulate a specific pay code to get the correct result

- if a Labour Record has Status "A" (Active), any calculated values will apply to that pay code.

- The STATUS field will directly affect how any amounts are calculated and the fields that are used.

- Be sure to read ALL the fields associated with the Special Calculations carefully, before proceeding.

ADDING LABOUR NUMBERS

To add a new record, do the following:

1. Starting this program will show a list of all LABOUR records in the file.

2. To add a NEW record to this file, go to the MENU Bar and click on FILE. Than select NEW from the Pull Down Menu. You can also use the NEW Icon in the Task Bar (under the Menu Bar) to add a record.

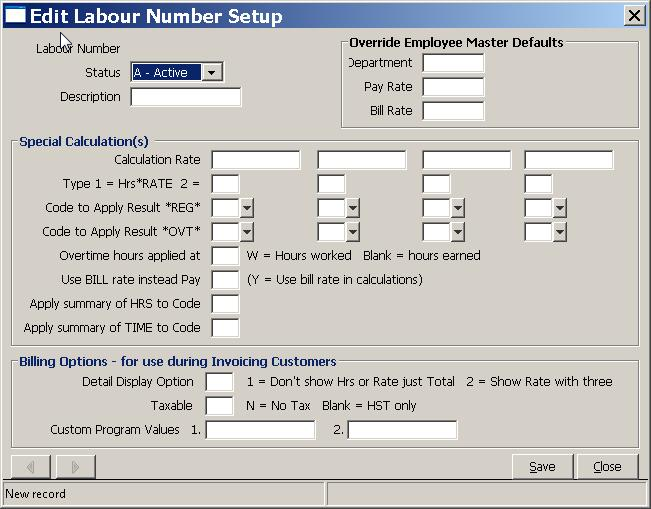

3. A BLANK record EDIT screen will appear. Fill in the appropriate fields (see Field Definitions below) than SAVE the record using the SAVE Button. The NEW record will be displayed as part of the main list.

UPDATE AN EXISTING LABOUR NUMBER

If you are not sure what the code is, use the listing that appears upon entry to this option.

1. Find the record, then Double click to select the record. The LABOUR NUMBER edit form will be displayed ready for update.

2. Make your changes, then SAVE the record using the SAVE Button.

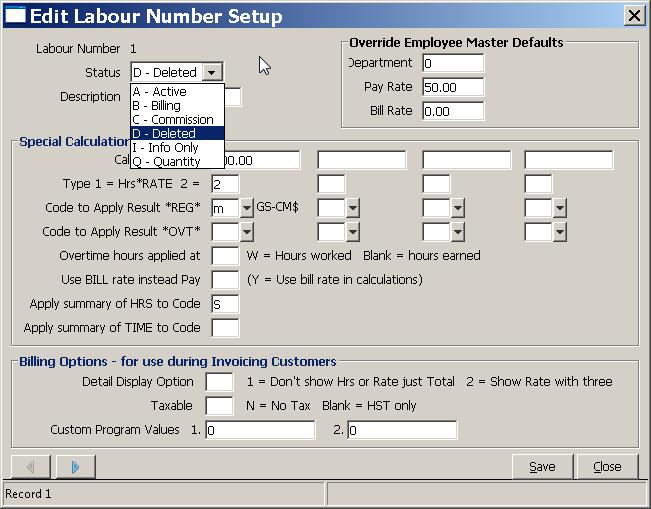

DELETE * EXISTING * LABOUR MASTER RECORDS

While you can flag a Labour Number as deleted (not active) it cannot be removed from the file. KLM recommends that you do not reuse LABOUR Numbers, as this will present issues when viewing historical data.

Upon entering this option, do the following:

1. Find the record, then Double click to select the record. The LABOUR NUMBER record will be displayed ready for update.

2. Change the STATUS field to "D" for DELETED. This flags the record as inactive. It will no longer appear on listings or be accessed.

3. Make your changes, then SAVE the record using the SAVE Button.

NOTE-1: Deleted records can be displayed by selecting VIEW (from the Menu Bar) and than clicking on DISABLED RECORDS option.

NOTE-2: Deleted records can be reactivated by changing the STATUS field from D back to it's original contents.

PRINT A LIST OF LABOUR RECORDS

Upon entering this option, you can print a hard copy of the this file, by going to the MENU Bar and clicking on the FILE option. Select PRINT from the Pull Down Menu. A standard Windows Print Setup screen will appear. Select the printer then click on OK to begin.

The report that is produced will show the following fields, DESCRIPTION, STATUS, DEPT. PAY RATE, BILL RATE TAX CODE and LABOUR NO. It is basically a hard copy list of what is displayed on the screen when you first enter the option.

FIELD DEFINITIONS

FIELD NAME |

DEFINITION |

LABOUR NUMBER |

Display only: The program assigns the Labour Number automatically. In future, always use this number when referencing this Labour record. |

STATUS |

When ADDING records, each STATUS has a unique effect on pay input records. The default is A for Active. Use the Drop Down Menu to change the Status field. See the Common Uses section for examples of what each Status type does. |

DESCRIPTION |

Enter a description that will provide unique identification for this Labour Number. The description appears whenever the labour number is accessed. |

DEPARTMENT |

Optional: Any Department Number assigned to this labour record will automatically be placed in a corresponding field. Department Numbers MUST be valid. |

PAY RATE |

Optional: The PAY RATE you place here will be applied to the employee's per hour Pay Rate. |

BILL RATE |

Optional. The BILL RATE you place here is applied to the customer's per hour Bill Rate in Menus #19 and #10. |

SPECIAL CALCULATION |

Fields consist of four Special Calculations can be attached to this Labour number, affecting up to 8 pay codes per labour input record. The results calculated will be applied as coded amount adjustments to the pay input records in Menu #19 associated with this labour record. |

CALCULATION RATE |

Represents the SPECIAL RATE (up to four rates) that can be used as part of the calculation. This value can be either a positive or negative number. |

CALCULATION TYPE |

Two types of calculations are allowed. If TYPE is 1, the results will be: Calculation Rate x Regular Hours of labour record or Calculation Rate x Overtime Hours x OVT rate of Labour record. If TYPE is 2, the results will be: Calculation Rate x Pay Rate of labour record x Regular Hours of labour record or Calculation Rate x Overtime Pay Rate x Overtime Hours x OVT rate of Labour record. |

CODE TO APPLY RESULT TO REG |

Enter a VALID PAY CODE to apply the results of calculation with regular hours and/or regular pay. |

CODE TO APPLY RESULT TO OVT |

Enter a VALID PAY CODE to apply the results of any calculation with overtime hours and/or overtime pay. |

OVERTIME HOURS APPLIED AT: |

Optional. If W for Hours Worked is entered, the Overtime Rate in the Labour record is overridden. The overtime rate will be set to one. NOTE: Hours Earned = Overtime Hours x Overtime Rate Hours Worked = Overtime Hours (no rate applied) |

USE BILL RATE INSTEAD OF PAY |

This option can be used for TYPE 2 calculations only. If Y entered in this field, the BILL Rate of the labour record is substituted for the PAY RATE of the labour record. |

APPLY SUMMARY OF HRS TO CODE |

To apply the total number of both regular and overtime hours to a particular PAY CODE, enter code here. |

APPLY SUMMARY OF TIME# TO |

To apply the amount in the TIME# field of the Labour record, to a particular PAY CODE, enter code here. |

DETAIL DISPLAY OPTION |

Two options for altering what is printed on the detail lines of an AR Invoice in Menu #28. If a 1 is entered here NO HOURS or BILLING RATE will be printed on the Customer Invoice, only the TOTAL $. If a 2 is entered any BILLING RATES printed on the Customer Invoice will have 3 instead of 2 decimal places. |

TAXABLE |

Enter N to override the normal taxation procedure for this Labour Detail record. Allowing the resulting AR invoice item to be HST tax exempt. |

CUSTOM PROGRAM VALUE |

The two fields provided are used in conjunction with customer programs. Leave these fields blank. |

COMMON USES FOR THE LABOUR NUMBERS

Listed below are the some common uses for this file, along with an examples of how to set up each (and the results you will get).

Keep in mind:

- Labour numbers can be setup for each type of product your employees make or job they perform.

- A unique PAY RATE can be assigned for each product or job identified.

- You can record either the actual hours worked or use the REG. and OVT. hours fields to represent the number of products produced.

- All wages are automatically applied to regular and overtime earnings (as long as record STATUS is A). All other Status types require you to apply the results to specific pay codes.

The samples shown below are very simple examples of what you are able to do with the Labour Numbers Setup File. There are too many uses for this file, for us to show you all of it's abilities.

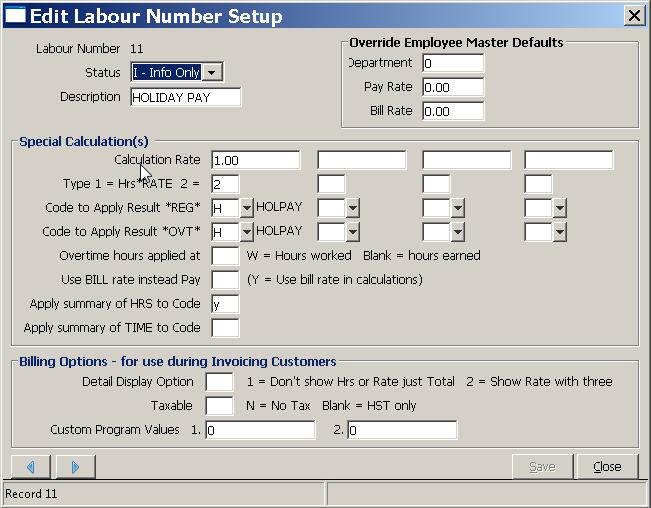

HOLIDAY PAY

This is one of several methods that can be used for calculating statuary holiday pay.

- Use Status I for Information (ie tracking extra items) regular/overtime hours and pay (max of 362.00).

The Labour Number record would look as follows:

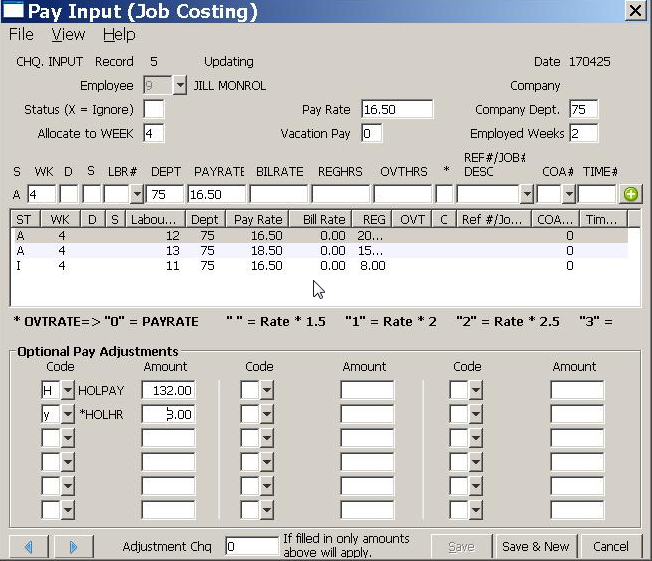

The result in PAY #19 would be as follows:

The employee will be paid $132 for 8 hours of work. The dollar amount is automatically applied to Pay Code H (for Holiday Pay) and the Hours Worked applied to Pay code y (for Holiday Hours).

The Labour Number's STATUS over-rides the default Labour Detail Line Status of A.

PIECE WORK

This is one way to pay an employee for direct production of a product (pay per piece assembled).

- Use Status Q when calculating using large quantities (Max for pay & bill rates 362.00).

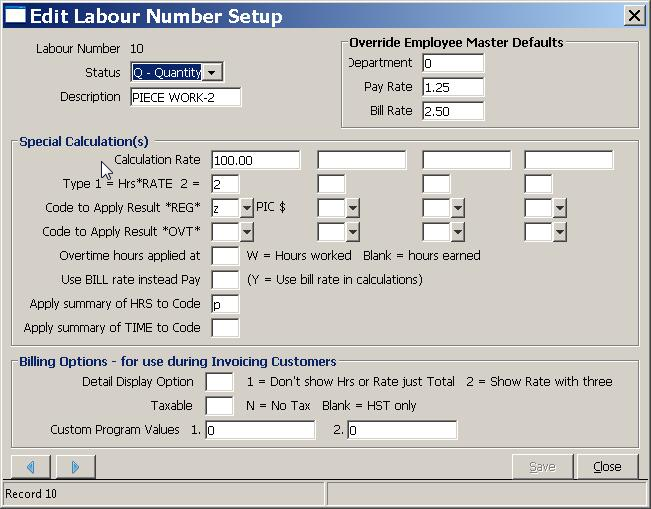

The Labour Number record would look as follows:

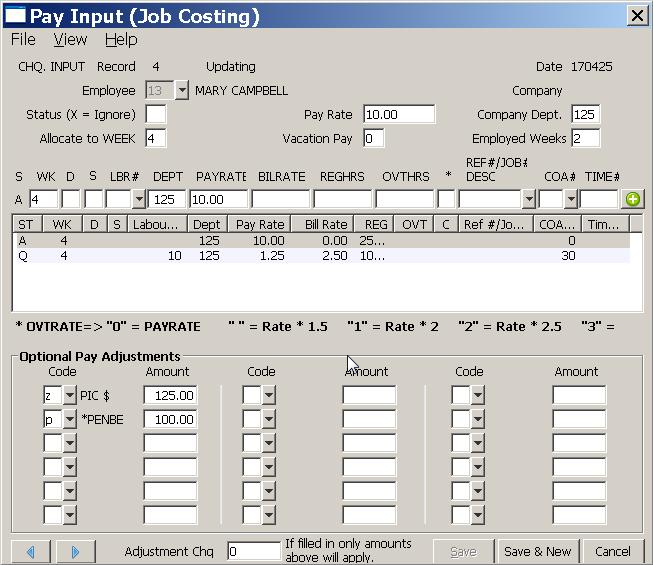

The result in PAY #19 would be as follows:

The employee will be paid $125 for 100 items (pieces) assembled. The dollar amount is automatically applied to Pay Code z (for Piece Work Pay) and the pieces made applied to Pay code p (for Pieces).

In addition, the customer (represented by COA #30) would be billed $2.50 for each piece assembled for a total of $250.

The Labour Number's STATUS over-rides the default Labour Detail Line Status of A.

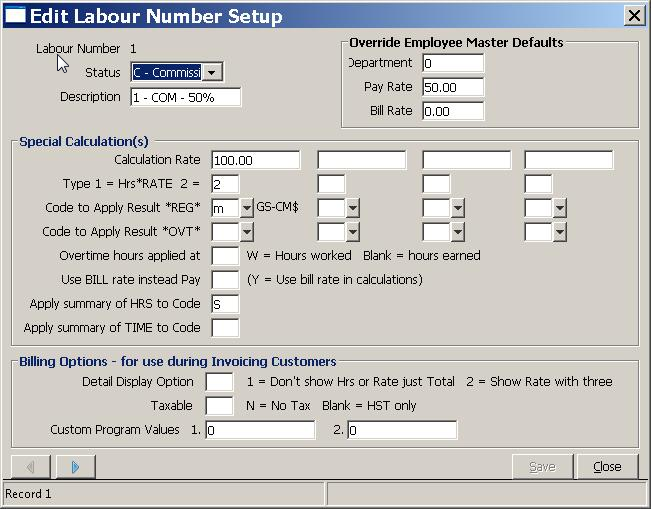

SALES COMMISSION

This is one way of calculating sales commission for an employee.

- Ues Status C - for calculating commission sales (by percentage) - pay & bill rates used as per cents (max of 362.00) - one quantity or amount

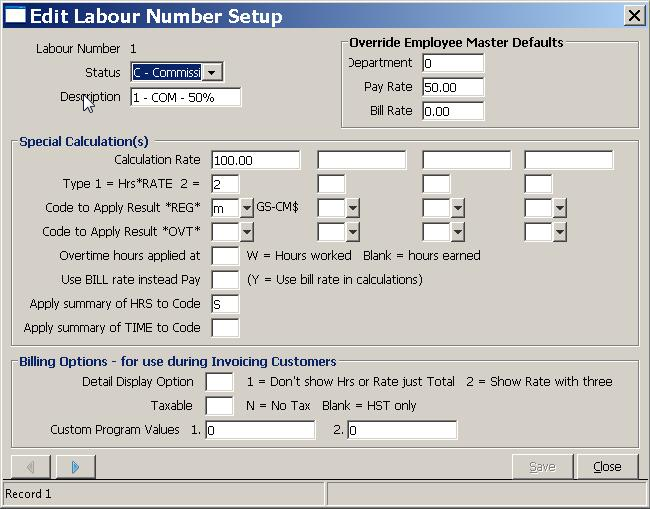

The Labour Number record would look as follows:

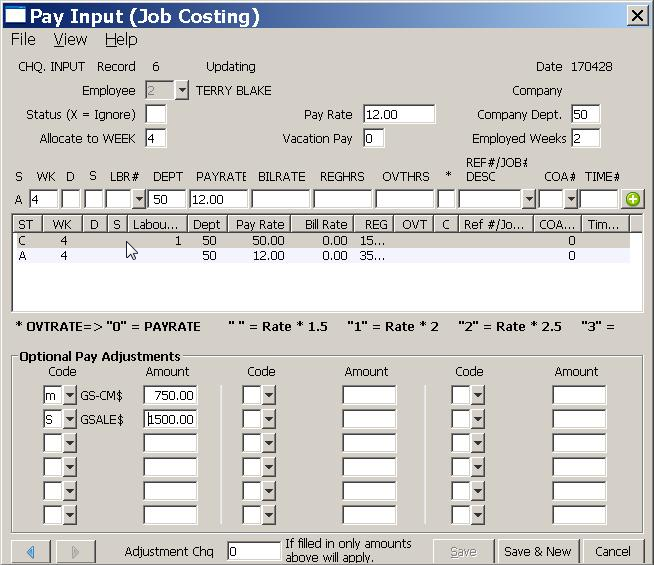

The result in PAY #19 would be as follows:

The employee will be paid $750 sales commission on $1500 of sales. The dollar amount is automatically applied to Pay Code m (for Sales Pay) and the Sales dollars (on which this commission is based) applied to Pay code s (for Sales).

he program automatically calculates the commission to be 50% of the sales dollars.

The Labour Number's STATUS over-rides the default Labour Detail Line Status of A.

BILLABLE SERVICES

This is one way to both pay an employee for a job or service and at the same time bill a customer for the same said service.

- Use Status B when calculating using large rates - one quantity or amount (max of 362.00).

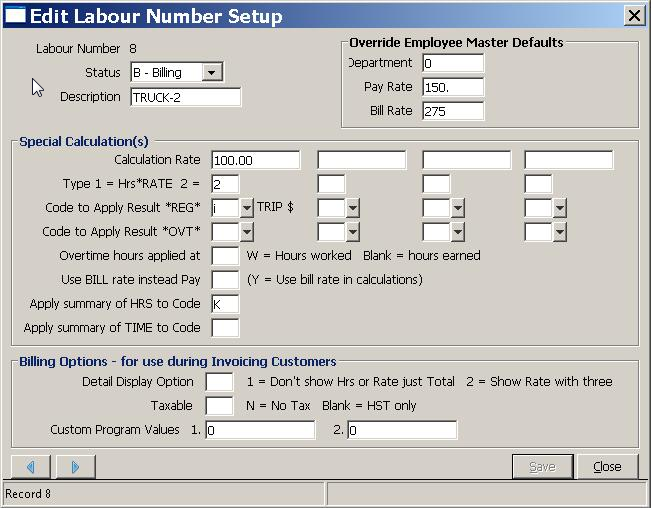

The Labour Number record would look as follows:

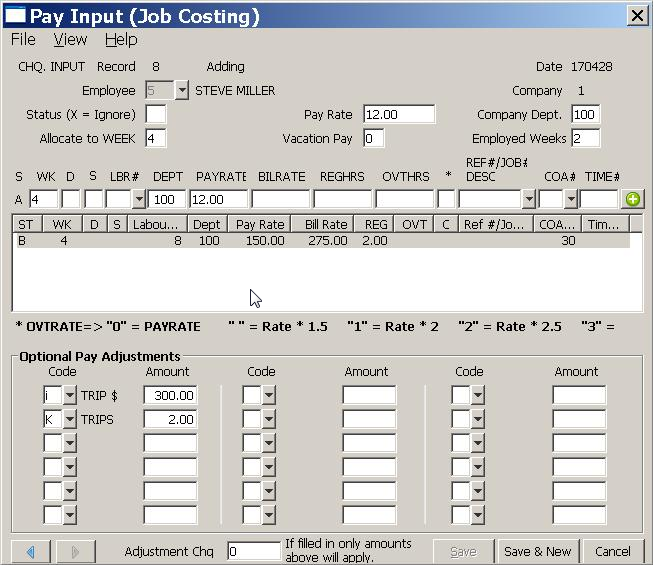

The result in PAY #19 would be as follows:

The employee will be paid $300 for 2 trips. The dollar amount is automatically applied to Pay Code i (for Trip Pay) and number of trips applied to Pay code K (for Trips).

In addition, the customer (represented by COA #30) would be billed $275 for each trip made for a total of $550.

The Labour Number's STATUS over-rides the default Labour Detail Line Status of A.