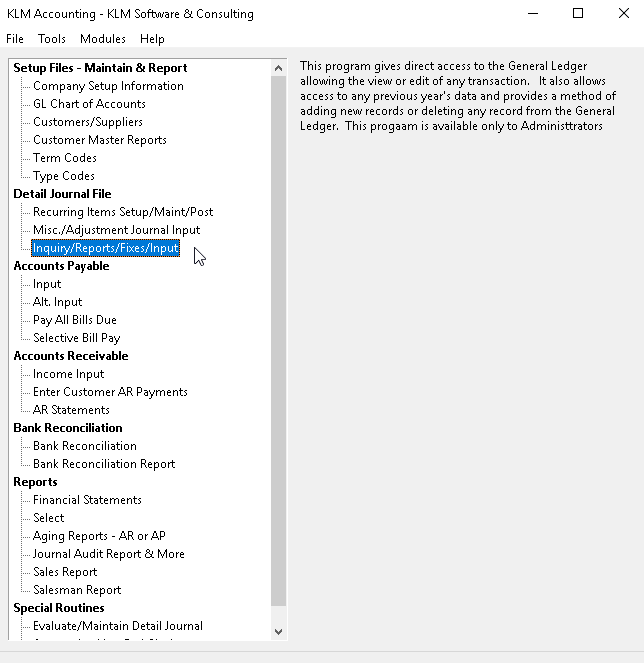

Accounting-Inquiry-Fixes

INQUIRY, REPORTS, FIXES, INPUT

PURPOSE:

This program allows direct access the GL data created by and used by all programs in the KLM Accounting System. The General Ledger contains all details for an entire accounting year. Each Accounting year is accessible by selecting the YEAR option on the first screen of this program. DAT is the default year which accesses the current accounting year.

The main purpose of this program is for general inquiries of the General Ledger. For the trained individual this file contains all the evidence necessary to investigate any problem and correct it.

An Administrator can edit, add or delete accounting detail journal records. The user must have Administrator access to run this program.

Any of the following tasks can be performed from this option:

KEEP IN MIND

Changes to this file should only be done if you have a good understanding of both accounting principles and the functions unique to the KLM Accounting Software.

Although this option allows you to edit journal records in this file, you should attempt to use other purpose oriented Menu options designed to create balanced entries. This option does not create balanced entries; what you see is what you get.

Keep in mind that along with the flexibility of this option also comes the responsibility not to place your detail journal in an out-of-balance situation.

Each Accounting Company has it's own journal detail file.

The linking system for journal records by GL ACCOUNT and COA# helps to access this large build up of data quickly.

If you change anything in this file you must run Evaluate/Maintain Detail Journal to evaluate the changes (if you change a Customer Number or GL Account number you must run a “complete re-link of journal records.

MODIFYING * EXISTING * JOURNAL ENTRIES

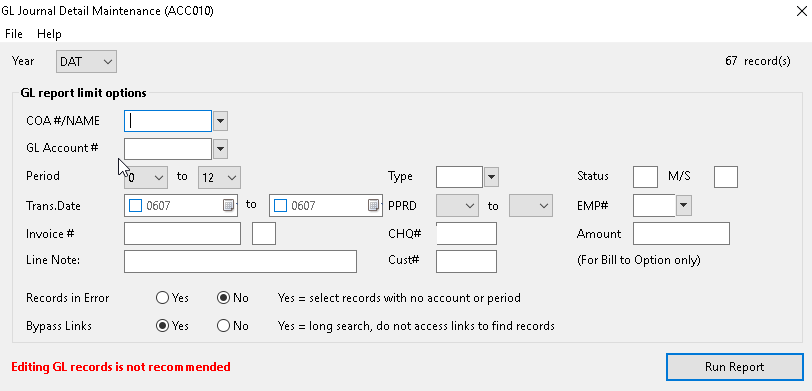

You can view any number of records, or grouping of records by use of GL Report Limits options on the first screen.

1) As you can access records from any accounting year, be sure to select the correct ACCOUNTING YEAR. The program will default to DAT for the current year’s records.

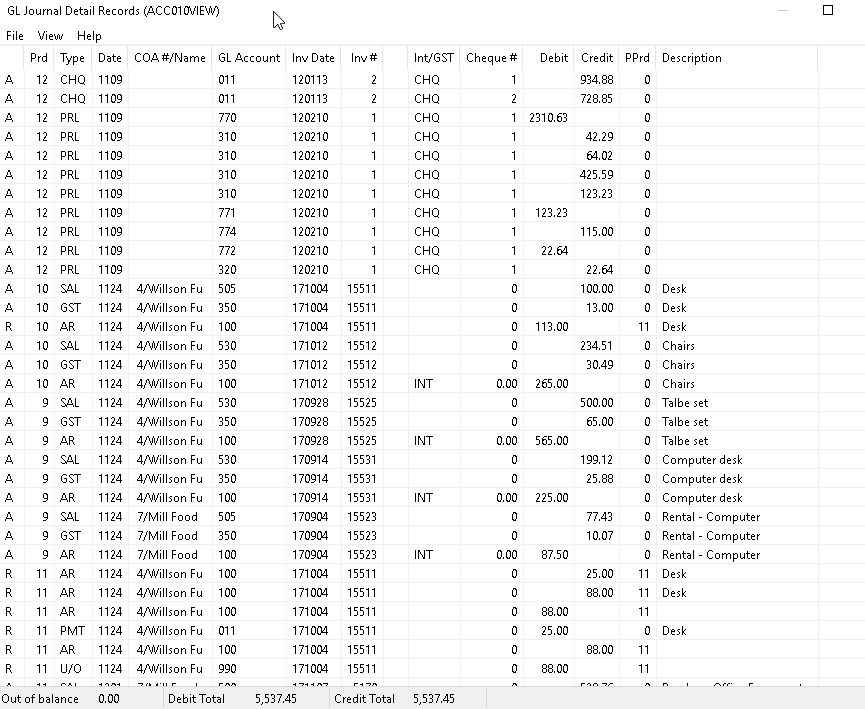

2) Once your selections are made, click on RUN REPORT button, to see your selections. A List/View screen will appear. Totals for both Debits and Credits will appear at the bottom of the screen. A Out Of Balance amount will appear in the Lower left corner of the screen.

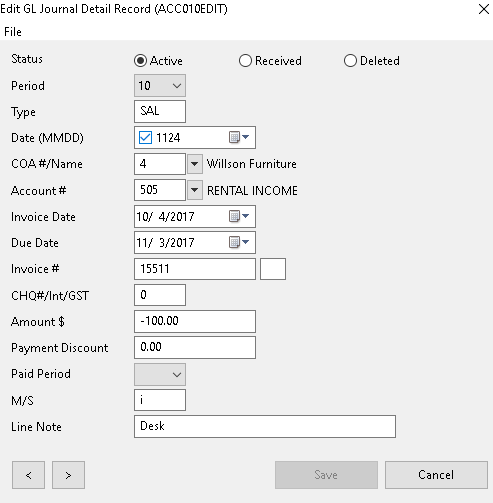

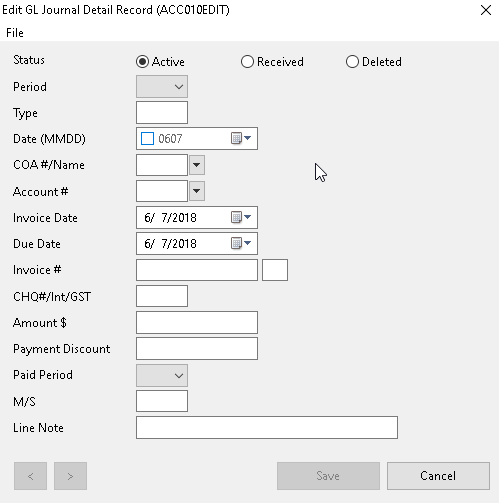

3) To EDIT a Detail Journal Record, double click on it and the EDIT screen will appear. Once all changes have been made, click on the SAVE button to save said changes. You are returned to the prior screen.

Note: Depending upon the selection of records, it is possible to have an Out Of Balance situation.

ADD NEW JOURNAL RECORDS

While this program does allow you to enter new journal records in this option, it is advised that you use the various other options available in this package, as they automatically create off-set entries.

NOTE: You MUST enter both sides of the journal entry. Use the OUT OF BALANCE total (shown at the bottom) to verify if an entry is correct.

In order to ADD records to the journal, you must first enter the LIST / VIEW screen. Use limits such as the PERIOD or Transaction Date you intend to apply any new records against. This will make it easier to find records once they have been entered.

1) As you can access records from any accounting year, be sure to select the correct ACCOUNTING YEAR. The program will default to DAT for the current year’s records.

2) Once your selections are made, click on RUN REPORT button, to see your selections. To ADD a Detail Journal Record, click on FILE then click on NEW. A blank EDIT screen will appear.

3) Once all fields have been filled in, click on the SAVE button to save the new record. You are returned to the prior screen. If the new record contained the same selection criteria (i.e. same accounting period) it should appear at the end of the List / View.

NOTE: You must enter the following fields (see Field Definitions for details): Status, Period, GL Account #, COA # and Dollar Amount. If the journal record has a credit amount be sure to place a (-) minus sign in before the dollar amount (i.e. a $100 dollar credit would appear as -100.00)

LIST/VIEW EXISTING JOURNAL RECORDS

From the list / view screen, you can print any of the records you have already selected.

1) Click on FILE, then select PRINT

2) A standard Windows print screen will appear. Select your printer than click on OK.

EXPORTING DATA Records

The program does allow you to export any group of GL Detail Journal records a CSV file format.

1) Select the group of records you wish to export, using this options “limits” section (on the first screen).

2) Verify the records, that appear on the LIST / VIEW screen.

3) While in the LIST / VIEW screen, select FILE

4) From the pull down list, select EXPORT, than CSV.

5) You will be prompted to enter a FILE NAME, the default is ACC010 and the extension is CSV. Click on SAVE to accept the name.

6) The list of records is automatically exported to the CSV file. When done, the message, EXPORTED TO ??.CSV appears. The ?? represents either the name you entered of the default ACC010.

7) Click on OK to finish the process.

NOTE: The CSV file will be stored in the same directory (folder) as you other KLM data files. This is the default but you can save the file to any folder in your computer. You can import this file into most “off the self” spreadsheet packages.

FIELD DEFINITIONS

Field |

Definition |

STATUS |

Enter ACTIVE (A status)or RECEIVED (R status) or DELETE (D status) |

PERIOD |

Enter the Accounting period the transaction belongs to. Periods should always be a value from 1 to 13. Only items carried over from the previous accounting year will have a period of ZERO. |

TYPE |

The Transaction TYPE is a three character short description assigned to every journal record as a guild. In a lot of cases it's set automatically by the programs that generate journal records. There are several Transaction Types which are reserved for specific purposes. They are as follows: AP for Accounts Payable (Menu# 11,11a,12,12a) AR for Accounts Receivable (Menu# 13 and #15} or CHQ - Cheques AP (Menu# 11,11a,12,12a) Reports (Menu 22) |

DATE |

Enter the Month and Day on which the record is being input. Serves as a batch date. The default is the computer generated date. Use the Date picker to help with this. |

COA# (NAME) |

OPTIONAL. Enter a VALID COA Number to use as a reference for this journal record. Accounts Receivable and Payable entries should always have a customer or supplier COA Number assigned them. This field SHOULD NOT be changed once the journal record has been posted through Menu #30. |

ACCOUNT NO. |

Enter a VALID GL Account Number for this journal entry. This field MUST contain a VALID entry, if you wish the record to be accepted. You can not bypass this field. This field SHOULD NOT be changed once the journal record has been posted through MENU #30. |

INVOICE DATE |

OPTIONAL. Enter an Invoice (reference) Date in year-month-day format from the original invoice, statement or bill. |

DUE DATE |

You may ignore this field if this journal record does not apply to the Accounts Payable or Receivables. Enter the date in year-month-day format. See Menus 11, 12, 12A, 13 and 15 for further details. |

INVOICE NO. |

OPTIONAL. Use this seven digit number to identify the original document (i.e. Invoice Number). The Accounts Payable section uses this field to group similar AP entries (items from the same invoice). |

CHQ#/INT/GST |

This field has several uses, depending upon the journal record's function and the stage at which the processing is done. For paid AP/AR entries the field stores the CHEQUE number associated with the payment. For active AP entries the field stores the dollar amount of any GST paid on the outstanding Invoice. For active AR entries the field stores the dollar amount of any INTEREST owing on the outstanding Invoice. |

AMOUNT $ |

A plus (debit) or minus (credit) amount to be posted to the GL ACCOUNT NUMBER indicated in this journal record. You WILL need a basic understanding of accounting principals to judge which it should be. |

PAYMENT DISCOUNT |

The discount field stores a dollar amount (or percentage) to be applied to either an outstanding Accounts Payable or Receivable entry at the time it is cleared (a cheque issued in Menu #12/#12A or payment recorded in Menu #15). |

PAID PERIOD |

This field stores the PAID PERIOD number. Both the Accounts Payable and Receivable sections record the accounting period in which payment was made, to the original AR or AP entry. |

M/S |

This field indicates from which section an entry was generated and for what purpose. The contents are usually informational, but the Accounts Payable section does need certain data in this field to function properly. If a C indicates that a cheque is to be printed for AP records generated in Menu #11 and processed in Menu #12. If a P indicates that a cheque was to be issued for an AP item in Menu #12 or a payment was received for an AR item in Menu #15. If a I indicates that an invoice was issued for a new sale in Menu #14. If a + indicates an GL Bank Account entry is to be listed in Menu #22 under the Cash Receipts (+) column regardless of the GL Bank amounts listed Negative amounts are usually printed in the Cash Disbursements (-) column. Similar to the above (+), but will force a (+) amount in the Cash Disbursement (-) column of the report. Positive amounts are usually printed in the Cash Receipts (+) column. If a $ indicates to the system that the journal record should be carried over to the next accounting year during Year-End Run (MENU#31). Normally only the outstanding AP and AR records are carried forward to period ZERO of the new year. If a p indicates the journal records were generated from KLM Payroll Menu #21. |

LINE NOTE |

OPTIONAL. Enter up to twenty seven characters, to identify this journal record. The DESCRIPTION field prints on AP Cheque Stubs in Menu #12. |

PROBLEMS LISTING OR VIEWING JOURNAL RECORDS

The following are answers to a variety of problems when listing journal records.

1) The records selected does not match ALL of the limits entered and were thus excluded.

As a rule, always try making the same selections again. If the results are the same, reduce the numbers of limits until the records in question appear. Remember that all LIMITS must match.

2) The records selected were not in the file accessed. This would be the case if you were looking at data under the wrong company number.

First make sure that you selections have not excluded the journal records you desire. If verification of your selection criteria does not produce results, then verify BOTH the Company Number and Year. If you are still sure that the journal records have been entered, try listing or viewing ALL journal entries without any limits. If the data records are physically in the detail journal file, they will be displayed.

3) The records selected used either the ACCOUNT or COA # which, if damaged, would result in the records being ignored. If any of the following occurs when you are trying to list or retrieve records, by ACCOUNT or COA number. Records are missing; not on reports etc. Report and/or screen listings appear to be repeating themselves; listing the same records over & over. Reports stop part way through listing.

All journal records are sorted (linked) by both GL ACCOUNT and COA NUMBER. This saves you, the user, time, by speeding up access to the data records when retrieving data by ACCOUNT or COA number, updating GL ACCOUNTS in Menu#2 and producing journal listings from any Menu option.

The sorting function of this option has been disrupted. As part of the POSTING options of this package,[Menu #30 ] [Evaluate/Maintain Detail Journal]provides provisions for resetting the sorting (linking) feature for both ACCOUNT and COA Numbers.

4) The journal records selected were flagged as Invalid when the last POSTING was performed. (See Menu #30 for details). This would cause the records to be ignored.

If the journal records you desire, do not appear even when no limits are applied to their retrieval, then the journal record have been "flagged" as "invalid" and cannot be retrieved using the normal methods, until they have been corrected.

KLM provides two provisions in this menu option that allow "display or retrieval" of records that would not otherwise be accessed.

To activate either provision, answer Y (for yes) to the appropriate field prompt.

- {Records In Error}will display any journal record that does not have a valid GL Account or Period number. This includes records with NO information in either field.

- {Bypass Links}will display ALL or any combination of journal records without using the sort (linking) feature. If a journal record will appear ONLY when this option is used see Menu #30 for further information.

If you have already run a POSTING in Menu #30 and the program produced an error report, use that report's information to retrieve the data records in question. One of the easiest way of calling up journal records in error is by the "Transaction Date".

ERROR TRACKING

Because of this option's flexibility, KLM automatically keeps track of the entries being made. At the bottom of the LIST / VIEW screen, there are three TOTAL Amount fields. OUT OF BALANCE Total, Total DEBITS and Total CREDITS. If you are in balance, the BALANCE Total shows a ZERO, if you are out of balance the amount you are out by is shown.

To be in balance all debit (+) and credit (-) entries, when added together, MUST equal ZERO. Along with the OUT OF BALANCE figure, the TOTAL number of DEBITS (+) and CREDITS (-) for the records listed, is also shown.

NOTE: Depending upon how you list the data records, the OUT OF Balance indicator may not always be zero. (i.e. if you list only cheque entries, which show as credits, you will technically be out of balance).