Accounting-Misc-Journal-Items

MISC. ADJUSTMENTS - JOURNAL ENTRY

PURPOSE:

This option allows you to enter simple input items such as bank service changes, bank transfers etc. that can NOT be entered elsewhere. Once saved, input is posted directly to the journal and CANNOT be altered from this program (See "Journal View/List/Fix/Input").

REQUIREMENTS:

The following files are affected by this option.

- COMPANY GL ACCOUNT DEFAULT INFORMATION (MENU #)

- GL ACCOUNTS for GL Account variations

ADDING NEW RECORDS

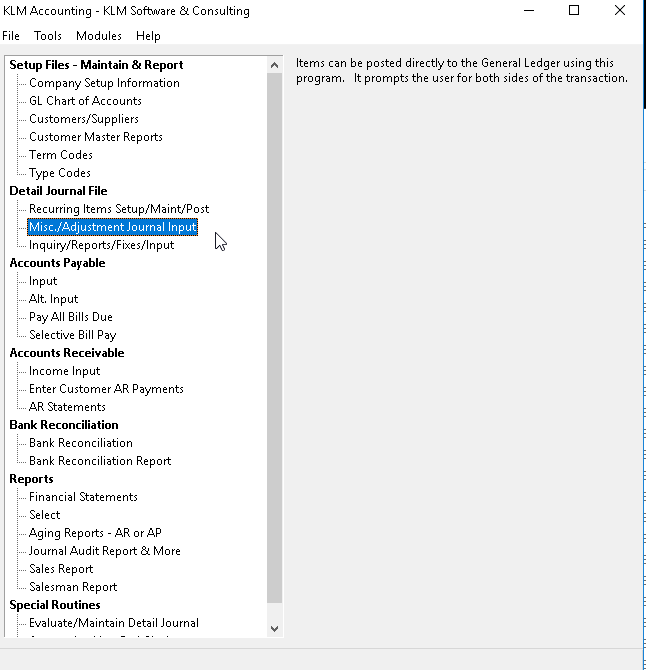

1) Select the Misc. Adjustments option.

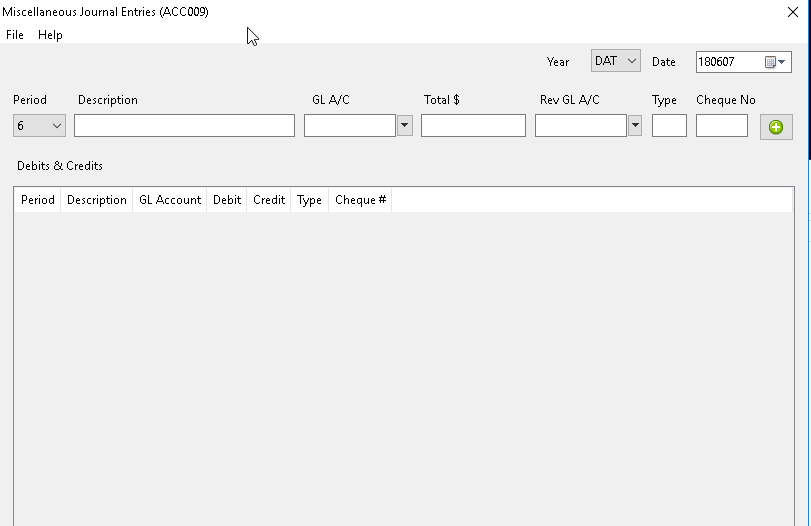

Select the Accounting YEAR (default is DAT for current year) and the Transaction DATE (default is today's date).

2) Using the fields provided (see Field Definitions for more details), make your journal entry then click on the + (Plus) button to SAVE the entry. Once saved, the journal entry will be displayed below.

3) The data fields will be cleared and you can than enter another journal entry or exit this option. The last 10 items posted are displayed on the bottom of the screen in case you are interrupted.

NOTE 1: An entry in this option will produce both sides of the journal record (debit and credit entries). The display below will show this.

NOTE 2: While you can do a variety of miscellaneous entries with this option, you can not assign either a Customer or Supplier to the entries.

FIELD EXPLANATIONS:

Field |

Definition |

YEAR |

Instructs the program to post items to an alternate detail journal file (i.e. for a prior fiscal year). The default will always be DAT for the current year. |

DATE |

All journal records posted from this program will be assigned this Batch date (month/day format). This Date is informational only, but is used in several system reports to limit journal records selected. Use the Select Date option to pick a different date from the default. |

PERIOD # |

This period is set for you, based on the current system data and the period ending dates for the Company. |

DESCRIPTION |

OPTIONAL. This Note will print on the AP cheque stub, and show on all journal records posted for this Bill. |

GL A/C |

Enter an appropriate GL Account number for the item. Treat this as the GL Account number for the DEBIT entry. |

TOTAL $ |

Total amount of entry. If this entry is a credit (-) any off-set will be a debit (+) amount. To limit confusion, treat this field as the DEBIT entry and allow the program to create the CREDIT entry automatically. |

REVERSE GL A/C |

Enter an appropriate GL Account Number to which the GL A/C automatically generated off-set entry will be applied. |

TYPE |

Optional. Enter a 3 character description such as CAS for cash or EXP for expense. The program stores it in the Transaction TYPE field in the Detail Journal record. |

CHEQUE Number |

OPTIONAL. Used as a look up reference in detail journal inquires. Usually filled in if recording a manual cheque. Filling in a cheque number will NOT automatically produce a cheque. |