Recurring Employee Deductions

Recurring Employee Coded Values

Purpose

To input and maintain special values unique to certain employees and to have those values applied automatically during the processing of payroll

The advantage of this option is to save time. By recording in this file transactions that MUST be done on a regular basis, payroll data can be generated without having to re-enter the details each time payroll is run.

Requirements

The following files should be setup before entering data:

- A Valid COMPANY Master (Menu #1)

- Valid EMPLOYEE Master File (Menu #5)

- Valid PAY CODES File (Menu #8)

A valid pay code MUST be used. An employee may not have more than one recurring record for the same pay code.

General

It is not necessary to fill in every field in this option. The fields that must be filled in will depend upon how the amount is to be applied to the employee's pay. Before entering this option, know the kind of adjustment and any limits that may apply.

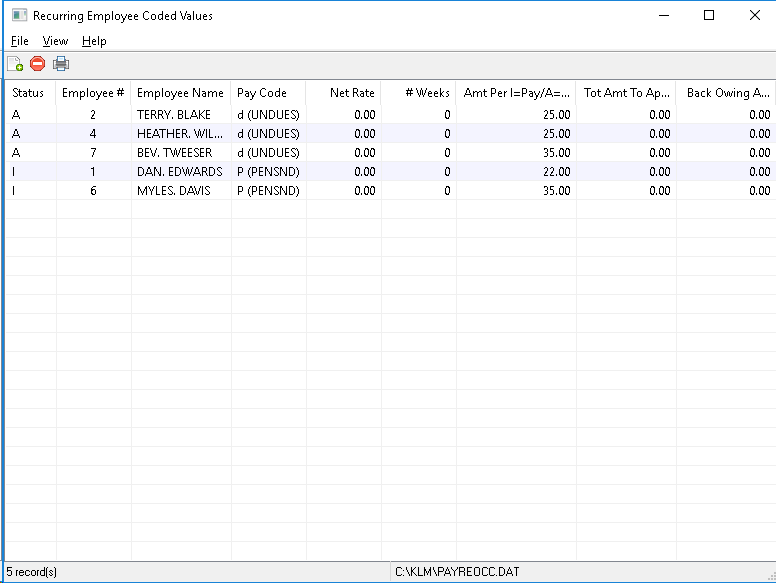

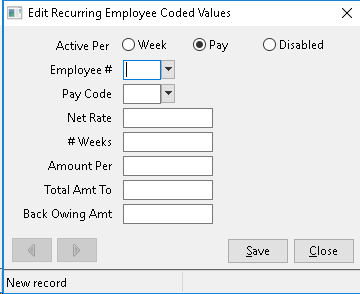

Adding New Records

Upon entering this option, the program will display a screen list of all records in this file. The screen will be blank if the file is empty.

1) From the MENU Bar, CLICK on FILE, then CLICK on NEW to select a blank record.

2) Fill in the appropriate fields. (see Field Definitions listed below) then SAVE the record before exiting (use the SAVE Button).

Modify/Delete Existing Records

1) Select the record to be modified or deleted by Double CLICKING. An EDIT window will appear.

2) Make any changes you wish, then SAVE the record using the SAVE Button.

List All Existing Records

To PRINT the Recurring Codes records, go to the MENU Bar and CLICK on FILE then CLICK on PRINT.

A standard Windows Print Setup screen will appear. Select your printer, than continue.

Field Definitions

Remember that not all fields need to be filled in. Which fields are filled in, depends upon the function being performed.

Field |

Definition |

STATUS |

Select WEEK (A) or PAY (I) Status. The status works in conjunction with the AMT-PAY/WEEK field. If you want to delete this record, select DISABLED (D). Note, that the program does not remove "disabled" records merely flags them to be ignored during processing. |

EMPLOYEE # |

Any valid Employee Number can be entered. The Employee's Name is displayed once an employee's number has been selected. |

PAY CODE |

Any valid Pay Calculation Code may be entered. The Pay Code Name will be displayed once the PAY CODE has been been selected. |

NET RATE |

This entry forces a percentage of the NET PAY to be added (CALC. % of) or deducted from the employee. Percentages must be entered in a decimal format ie: 20% would be .20. The RATE is multiplied by the NET PAY amount to arrive at the actual dollar amount deducted or added. The program uses whatever NET PAY amount has been calculated up to the point at which this Pay Code was accessed. |

WEEKS |

This field allows you to apply an amount for a certain number of actual{weeks}or actual{pay periods} depending on what is in the STATUS field. If STATUS is an I, enter the number of PAY PERIODS you wish he amount to effect the employee's pay. If STATUS is an A, enter the number of actual WEEKS you wish the amount to effect the employee's pay. |

AMOUNT |

The dollar amount entered will be added or deducted either every WEEK for A Status records or every PAY, if I is in the STATUS field. |

TOTAL AMT |

A dollar amount entered in this field limits the total amount that is applied to the employee's pay. Once the dollar amount entered is deducted or added to the employee's pay, this record will deleted. |

BACK OWING |

This amount can be entered alone or in conjunction with other functions. The amount is applied as a lump sum to the employee's pay, in addition to any other amounts already being applied. Note, As part of the year end procedure, this field is used as a place holder for accrued amounts such as Vacation Pay (see MENU #31) that are carried over. |

Common Uses For This Option

The most common types of adjustments issued are listed below. As well as requirements for each type.

Straight Deduction or Addition

- In most cases you are applying a dollar amount unique to this employee on either a weekly or pay period basis.

- The program knows the pay code's function (i.e.to deduct) these amounts should be entered as positive figures.

- If the amount is multiplied by the number of actual weeks worked, the STATUS must be A and the AMOUNT field must be an amount per week. If the amount is a straight deduction/addition applied on a per pay basis, then the STATUS must be I and AMOUNT field must be a per pay amount.

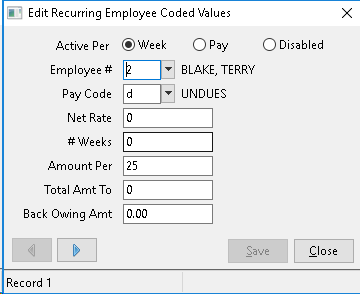

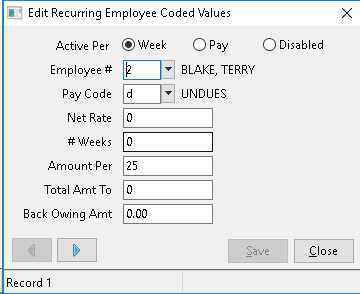

The entry below would produce a straight deduction for Union Dues in the amount of $25.50 on a weekly basis. If you had a bi-weekly payroll $25.50 would be multiplied by 2.

Wage Garnishee (% of Net Pay)

- Forced deductions, such as unpaid child support or income tax are usually calculated as a **percent of net pay. **

- The pay code W (for wage garnishees) is provided as default Your pay codes file may contain a different code for such deductions.

- The % OF NET RATE field must contain a decimal amount (i.e. 50% would be .50).

- The position of the code has a direct effect on the amount being calculated. Most garnishees are taken after all standard deductions (CPP/QPP, EIC and Income Tax).

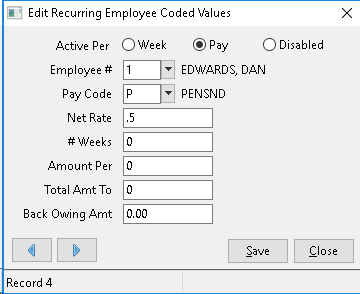

The entry below would produce a deduction of 50% of the NET Wage for said employee.

Overriding Existing Deductions

- This can also be used to override fixed calculations normally performed on employee's pay (i.e. union dues).

- Most employee's union dues deductions would be the same but you may need to deduct a different amount for some.

- Be sure to exempt the employee from the deduction (Menu #5) so that only one amount is taken.

- Enter the code and amount to deduct here. In most cases this would be a straight adjustment to the employee pay.

Time Limited Adjustments

- Items such as company pension may have a maximum per year to apply. Use the WEEKS and the TOTAL AMT field to limit the time period of the adjustments taken.

- If using the WEEKS limit, ensure the number of weeks corresponds with the adjustment type. If the adjustment is per pay, then the number of weeks represents the number of pay periods the adjustment is to be taken over. If your adjustment is per weeks worked then the number of weeks represents the real number of weeks the adjustment is to be taken.

- If a time limit is taken, once the limit is reached, the entry will be removed from the recurring file.

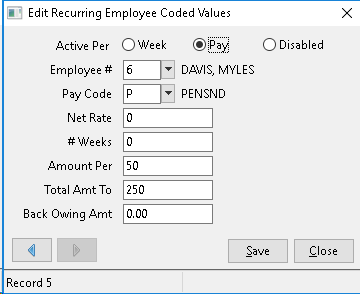

The entry below would produce a deduction of $50 to pension plan per pay until the total amount of $250 has been deducted. Once the total has been reached, this record would be deleted.

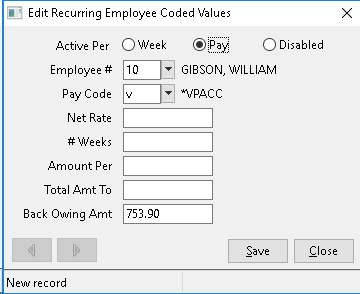

Back Owing Amounts

- Occasionally, a need to apply a lump sum to an employee's pay, in addition to or instead of regular deductions, by placing the amount in the BACK OWING field.

- Once a back owed amount has been applied, the record is removed and if other adjustments exist only the back owing amount is removed.

- The program automatically applies entries to this field for items. (i.e. year-end accrual carry-overs such as vacation pay.)

- Upon triggering Back owing for pay codes, any amount that can't be applied to an employee's earnings records is stored here until a pay cheque is issued.

The entry below will apply the amount of $753.90 to the employee's vacation pay accrual (pay code v).