Year-End-Closing

PAYROLL YEAR END CLOSING

PURPOSE:

DUE to Revenue Canada's regulations, requiring all reporting for payroll to be done on a **calendar year **basis, you MUST close your payroll files at the end of each calendar year. Doing so ensures that reporting done for that year contains only that data.

This option performs the needed maintenance routines to close off the present year and transfer the contents to a unique historical year. Once this option is run, you'll no longer be able to produce pay cheques for said year. Reports may be run for the closed year and earnings can be modified if needed.

Revenue Canada's regulations say ALL PAY CHEQUES ISSUED(but not necessarily earned)in a calendar year are part of that years data.

This option MUST be run AFTER the last pay cheques are issued in December and BEFORE the first pay cheques are issued in January.

GOVERNMENT Payroll Changes. As a rule, Revenue Canada changes the standard payroll deductions like CPP/EIC and Income Tax on January 1st of each year. These changes are not part of this option's functions, this is done by running PAYROLL UPDATE.

KLM Software does provide an update utility program to an client who has a maintenance agreement with KLM Software & Consulting. If you do not have this agreement contact our offices during regular business hours.

TO RUN THE YEAR END ROUTINE

The steps that follow represent the standard routine for completing a successful payroll year end.

BEFORE RUNNING THE YEAR END

Before running the year end, perform the following functions:

- Make sure you have complete ALL of the payroll tasks for year you wish to close. You can NOT add payroll records to a prior year once you have run this option.

- Run a Year To Date listing, for all earnings, in Menu #24 to compare with the "after year reports".

- Do a DATA backup of the current year's data. You will need this backup should you make a mistake or having problems with this option.

DURING RUNNING OF THE YEAR END ROUTINE

Do NOT run this routine more than once as it will wipe out data files for the prior year, if you do so. If in doubt as to whether the program has worked, check the effected files first, before running this routine a second time.

Follow the steps below to complete the year end routine.

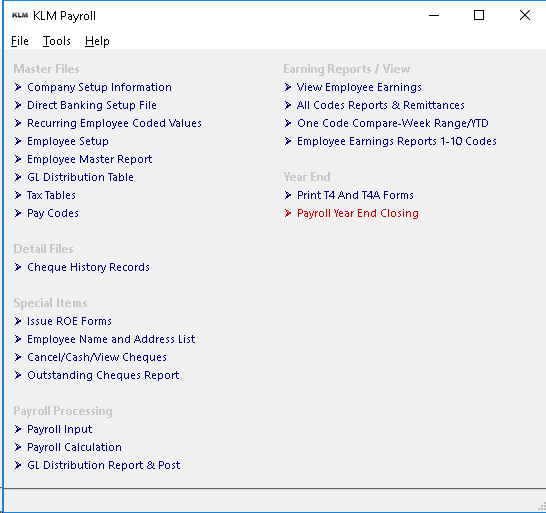

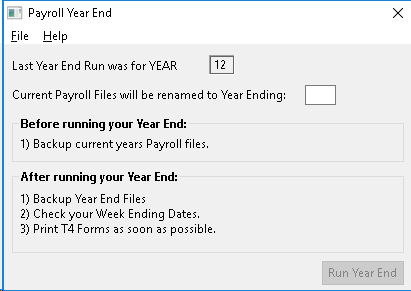

- From the KLM Payroll System Selection Menu, select Payroll Year End Closing. The Payroll Year End screen will appear.

- You have to answer only one prompt. The answer to this prompt determines the File ID that will be used when the present year's data files are copied to a newly created historical year. This 2 digit number SHOULD always represent the year number (i.e. 2012 would be 12) of the calendar year being closed.

- With the appropriate YEAR in the prompt, CLICKon the RUN YEAR END Button (at the bottom right of screen). The processing will begin. DON'T INTERRUPT THE PROGRAM.

The following tasks will be performed:

- This years' earnings record pointers in each employee master record are moved to last years earnings record pointers.

- This years EARNINGS HISTORY FILE is copied to a NEW historical year and the current year's file deleted.

- Any accrual carry-over amounts are transferred from last year's files and temporary placed in the Reoccurring Codes file. These amounts will be added to the appropriate accrual codes when the first payroll run is done.

- This years WEEK ENDING DATES file is copied to a NEW historical year and the current year's file updated.

While the program is processing, a series of messages are displayed, indicating the routine being run. DO NOT INTERRUPT PROCESSING! The prompt YEAR END COMPLETE will appear once the routine is done.

AFTER THE YEAR END RUN IS COMPLETED

After you closed the payroll year (run this menu option), perform the following routine:

Verify the following files to be sure of correct processing

- For the Cheque History verify both the current and prior year's files (the current year MUST BE BLANK) and the prior year should contain last year's data.

- For the employee links verify by listing all employees for the prior year. You should not be able to do this for the current year.

- Check the Week Ending Dates file data has been updated and if necessary adjust to match this year's payroll date schedule (check for each active company).

The last step for year-end should be a backup of both the current and prior years' data files.

Updating Payroll Tax Files

Once the year end has been done, you must update the current year's payroll files, so the proper deductions are taken.

The tax tables must be updated before you do your first payroll for the current calendar year.

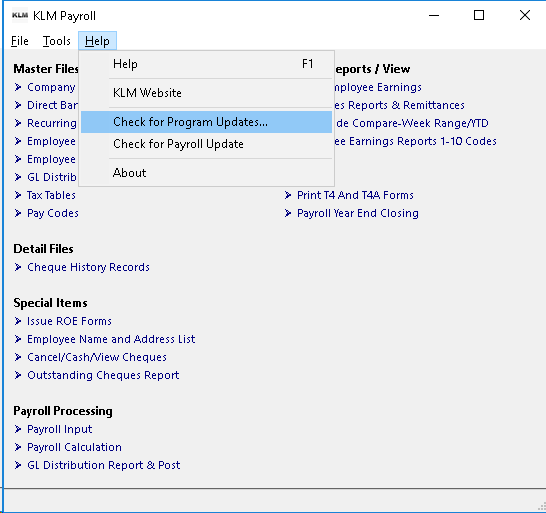

- From the Main Menu, go to the HELP Section and CLICK on CHECK FOR PROGRAM UPDATE (to update the software package). Follow the prompts. The program will re-install the most current version of the Payroll package.

- Once done, go back to the HELP Section (off the Main Menu) and CLICK on CHECK FOR PAYROLL UPDATE (to update the payroll tax table files. Again follow the prompts to complete the process. A printout of your Payroll Calculations file (PAY #8) is provided.

If you experience difficulties in either downloading a new version of KLM's programs or the updating the files, run the routines in the HELP Menu again. If problems persist, contact KLM Software directly.